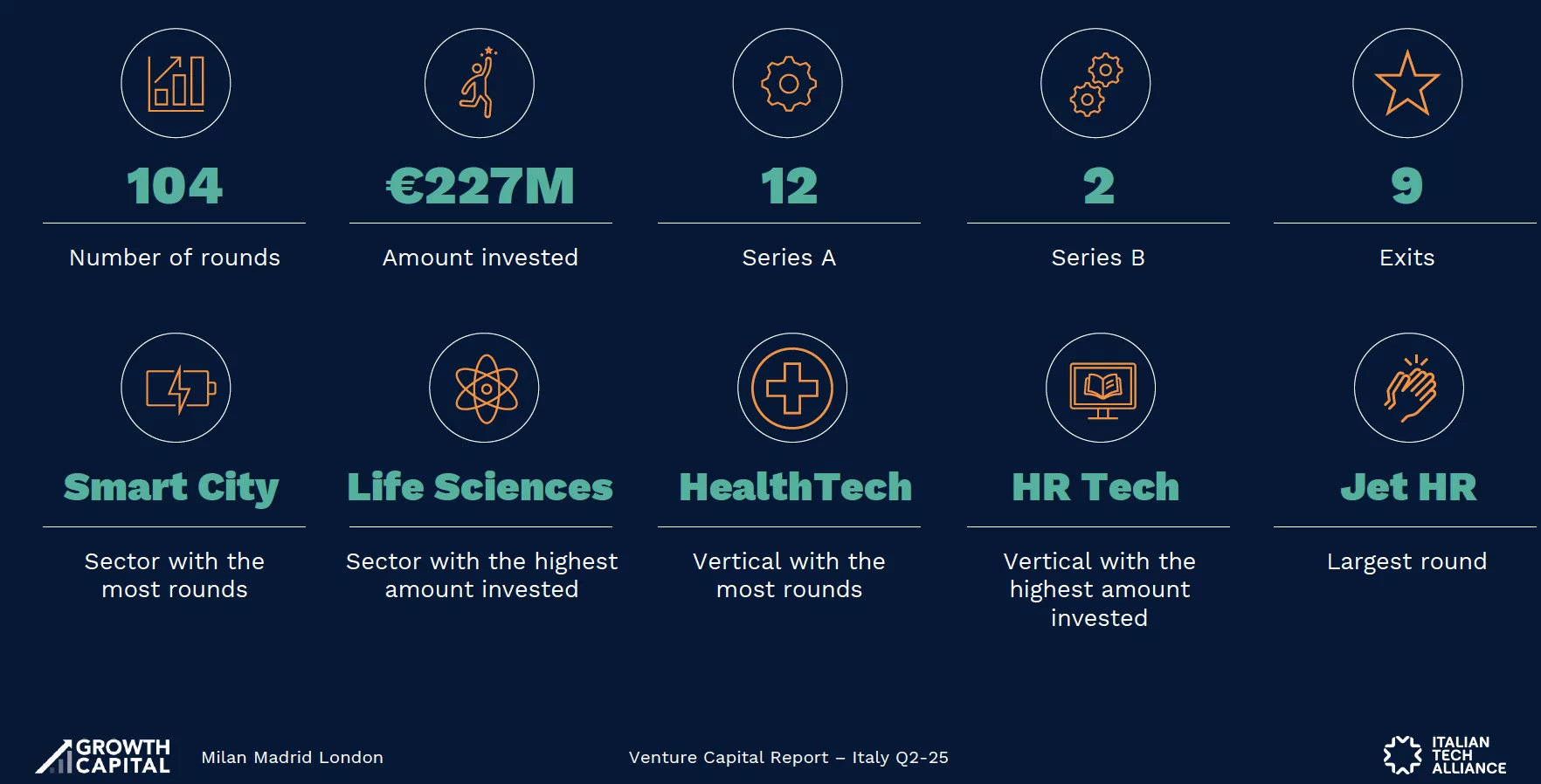

The total amounts to €227 million spread across 104 investment rounds, of which 12 were Series A and 2 were Series B. The sector with the highest number of rounds was smart cities, while life sciences recorded the highest amount raised. The most significant round in terms of amount raised was Jet HR, which closed at €25 million. There were nine exits. These are the figures relating to investments in start-ups and scale-ups in Italy during the second quarter of 2025, according to the timely Observatory on venture capital in Italy – produced by Growth Capital in collaboration with Italian Tech Alliance, which monitors VC investment trends in Italy and the main trends in the Italian innovation ecosystem on a quarterly basis.

In Europe, figures show that €14 billion was invested in 2,490 rounds, with the second quarter of 2025 recording a 13% decline compared to the first quarter of the same year, in line with the last nine quarters in terms of both the number of rounds and the amount invested. With €29 billion raised in 5,362 rounds, the first half of 2025 continues to show stability compared to 2024, both in terms of amount invested and number of rounds. Looking at individual countries, in the first half of 2025, the VC ecosystems in the United Kingdom and France are slowing down compared to last year. In contrast, Spain has had an excellent start, especially in terms of the amount invested.

In Italy, 104 rounds were closed in the second quarter of 2025, in line with the first quarter of 2025 and with the average for the quarters of last year. With €227 million invested, the second quarter of 2025 recorded the lowest amount invested since the second quarter of 2024 and marked the third consecutive quarter of decline, with no mega rounds. . Looking at the data for the first six months of 2025, with €545 million raised in 210 rounds, the first half of the year is in line with the half-yearly average of the last three years without mega rounds, both in terms of number of rounds and amount invested.

Looking at the segmentation of the number of rounds by type, in the second quarter of 2025, pre-seed and seed rounds accounted for 64% of all rounds. In terms of funding, Series A rounds accounted for 42% of the total invested, while Series B rounds accounted for 8%. In the first half of 2025, most rounds were also attributable to pre-seed, seed and bridge rounds, while Series A rounds attracted the majority of investments.

In the second quarter, the smart city sector recorded the highest number of rounds (20), followed by fintech with 16 and lifescience with 15 rounds. Smart city also topped the rankings in the first half of 2025 (32 rounds), followed by software (29) and lifescience (27). In terms of investment amounts, the top three sectors remain unchanged: lifescience leads with investments of €49 million, followed by fintech with €42 million and smart city with €40 million. However, the distribution shows a significant gap, with more modest investments in other sectors. In the first half of 2025, the life sciences sector leads with an even more pronounced gap compared to other sectors, highlighting a shift towards more capital-intensive industries.

Analysing the five main deals of Q2-2025, Jet HR leads the way (€25 million, Series A), followed by Iama Therapeutics (€15 million, Series A) and Blubrake (€12 million, Series B). Sibill ranks fourth (€12 million, Series A) and Moneyfarm fifth (€11.8 million, bridge).

“Italy maintains the highest number of rounds but has not yet seen any capital increases exceeding €25 million this year. We expect these to become more frequent in the second half of the year, making 2025 the year with the highest number of rounds and the highest amount invested without mega rounds. Despite the difficulties and the historically low sentiment recorded by the VC Index (an indicator on a scale of 1 to 10 calculated every six months, which provides an indication of the stage of development of the VC ecosystem in Italy and the sentiment of its players, ed.), there is cautious optimism for the deployment of new capital, thanks to the steady number of new funds announced and the potential increase in Series B and higher rounds, resulting from the solid pipeline of over 150 Series A rounds for the three-year period 2022-2024,” comments Fabio Mondini de Focatiis, founding partner of Growth Capital, in a note.

“The data presented today does not show the growth that we would have expected,” says Francesco Cerruti, general manager of Italian Tech Alliance, “which would have been a natural consequence of the increased attention this sector has been receiving in recent months. It should be noted, however, that in the second quarter of 2025, the foundations were laid for concrete progress both in terms of European regulations, with the presentation of the Choose Europe strategy by the Commission, and at the national level, with a series of measures aimed at improving the effectiveness of certain provisions contained in the Annual Competition Law, which are intended to attract more institutional investors to this area. That said, it must also be recognised that a quantum leap is needed to bring the ecosystem’s figures up to the expectations and potential of operators.

The report can be viewed at this link.

ALL RIGHTS RESERVED ©