What role does corporate venture capital play? How do large companies contribute to supporting the development of the Italian innovation ecosystem? What investment formulas and industrial and financial interests are involved? These are the questions addressed in the report on CVC in Italy produced by Italian Tech Alliance in partnership with Growth Capital, Rucellai & Raffaelli, Soverency and other leading players in the Italian innovation ecosystem.

It appears that CVC is gradually establishing itself in Italy as a strategic lever for promoting innovation within large companies, but there remains a significant gap compared to European and American benchmarks. The study was presented with contributions from Alessia Cappello, Councillor for Economic Development and Labour Policies of the Municipality of Milan; Francesco Cerruti, General Manager of Italian Tech Alliance; Giacomo Bider, Senior Associate, Growth Capital; Enrico Sisti, Partner at the law firm Rucellai & Raffaelli and coordinator of the report; Isabelle Veil, co-founder of Soverency; Andrea Birolo, Head of Group Digital Business CVC & Partnership at Reale Group; Francesco Sacco, Corporate Venture Capital Investor at Terna Forward; Giovanni Calabrese, Investment Manager & Head of CVC at Sella Direct Ventures; Sebastiano Silvestri, Head of Corporate Venture Capital at A2A; and Elena Lavezzi, CEO of Znext at Zanichelli Editore.

In the United States, CVC is well established: in 2024, there were 2,883 rounds involving CVC, worth over $108 billion. On average, one in five rounds was supported by corporate investors, generating about half of the total capital invested. In Europe, however, the scenario is growing: CVCs participate in 20% of rounds, representing 47% of investments, for a total of $28 billion in 2024.

In 2024, CVCs participated in 15 rounds in Italy, raising a total of €69 million. In 2023, the amount was significantly higher, at €228 million in 19 rounds, thanks to particularly significant transactions that contributed to a record figure of €109 million. Excluding these transactions, the impact of CVCs on the Italian venture capital ecosystem stands at around 5% in terms of amount and fluctuates between 4% and 6% in terms of number of rounds, as shown by data from the last five years.

The report shows that Italian CVCs are focusing their strategies mainly on foreign markets: 59% of investment rounds involving an Italian CVC financed foreign start-ups, which accounted for 80% of the amount raised in those rounds. Notable examples of this international orientation include Angelini Ventures and Eni Next, which made only two of 14 investments and four of 27 investments in Italy, respectively, with a preference for startups located abroad.

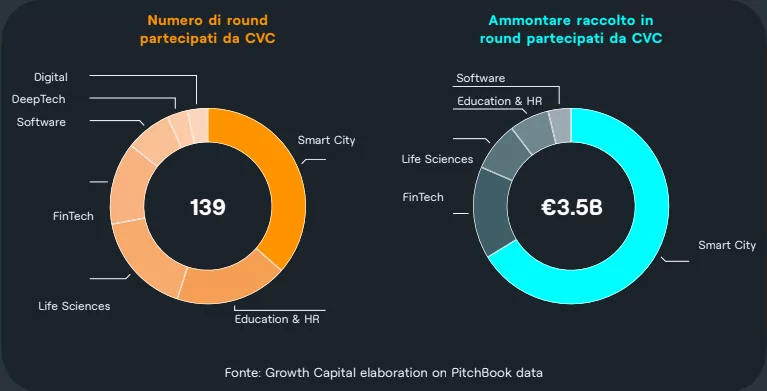

The sectors favoured by Italian CVCs reflect the core activities of the companies: smart cities, fintech, life sciences, education and HR. Most corporations adopt an investment strategy aligned with their business, with the primary objective of acquiring technologies that are functional to corporate growth, known as a driving strategy.

Direct investment approaches through unregulated investment structures, often organised as evergreen vehicles, are prevalent. Hybrid models that combine direct and indirect investments, such as Angelini Ventures and Edison, or participation in multi-corporate funds, such as CDP Corporate Fund, are also very common. And then there are those who have chosen a model more closely aligned with the concept of venture builder, such as the newly formed Znext.

CVC in Italy is a phenomenon that is maturing. Although still limited in terms of numbers and systemic impact, it is showing signs of growth and consolidation. The challenge is to create stable, autonomous structures that are well integrated into the corporate fabric, equipped with clear tools and metrics, and endorsed by top management. Corporate venture capital can become a fundamental pillar of finance for innovation in Italy, but this requires a cultural shift: from CVC as a simple tactical tool to a strategic lever for innovating and transforming Italian industry.

“Corporate venture capital represents a strategic opportunity to strengthen the link between large corporations and innovation, but in Italy we are still only at the beginning of this journey. The data shows positive signs, but greater awareness, dedicated structures and a change in mindset are needed to transform CVC into a stable driver of growth and competitiveness,” commented Davide Turco, president of Italian Tech Alliance, in a statement. If well structured, CVC can become a fundamental tool for identifying new technologies, attracting talent and generating long-term innovation. This study aims to be a starting point for promoting the growth of a CVC culture in Italy, leveraging existing experiences and encouraging the emergence of new models, because a solid innovation ecosystem also requires corporations to play a more active and structured role in supporting the most promising start-ups in our country.

Italian companies are increasingly interested in corporate venture capital because it represents a relatively low-cost way to access innovation ecosystems that would otherwise be inaccessible to them. It is also something that has its roots in Italian industrial history: ARM, the subject of the largest IPO in 2023, was born out of a corporate venture capital initiative launched by Olivetti in the 1980s. However, two things are essential: the emergence of market practices that facilitate followers and the alignment of interests with co-investors,” says Sisti.However, two things are essential: the emergence of market practices that facilitate followers and the alignment of interests with co-investors,” says Sisti.

“Corporate venture capital is a fundamental lever for connecting industry and innovation, but in Italy it is still underutilised in a structured and strategic way. The potential is clear, as is the gap compared to international benchmarks. To bridge this gap, dedicated teams and greater integration between start-ups and corporations are needed. This study provides a snapshot from which to build a more ambitious and competitive Italian model,” adds Fabio Mondini de Focatiis, founding partner, Growth Capital.

ALL RIGHTS RESERVED ©