Startupbusiness participated in MyFintech Week 2025 in Kuala Lumpur, an event held between 4 and 7 August 2025, which saw the participation of keynote speakers from Malaysia, Singapore and Hong Kong, the three strongest connected fintech ecosystems in the region, engaged in ongoing collaboration on shared issues and common visions for the future of digital finance. The conference took place at a crucial moment: the final phase of the Financial Sector Blueprint 2011–2026, a process that in just over a decade has profoundly transformed the Malaysian financial system, making it more inclusive, widespread and digital.

Today, Malaysia boasts a network that reaches almost every corner of the country: 96% of sub-districts have at least one physical access point to financial services within ten kilometres or a five-kilometre radius, with over 3,300 banking agents and 32 mobile banks, two-thirds of which are in the east of the country. Ninety-eight per cent of adults have a formal account, 97% have a deposit account (compared to 87% in 2011) and almost 800,000 people have taken out microinsurance or takaful products (a mutual guarantee system based on Islamic finance, ed.). The use of digital services is now almost universal: 92% of adults use them, with an internet banking penetration rate of 141% and mobile banking of 97%, compared to just 5% in 2011. These figures testify to a quantum leap made possible by structural reforms, targeted investments and strategic partnerships, creating fertile ground for open innovation and internationalisation initiatives.

For the first time, MyFintech Week was co-organised by Bank Negara Malaysia together with the Securities Commission Malaysia, the Asian Institute of Chartered Bankers, the Malaysia Digital Economy Corporation and the Fintech Association of Malaysia, a coalition that embodies this year’s theme: ‘Ideate, Innovate, Co-create: Shaping the Future of Finance Together’. Payments Network Malaysia (PayNet) is one of the central nodes of this network: in addition to managing the country’s main payment infrastructures, it leads projects such as the National Fraud Portal and cross-border QR connections, facilitating the entry and growth of local and international businesses.

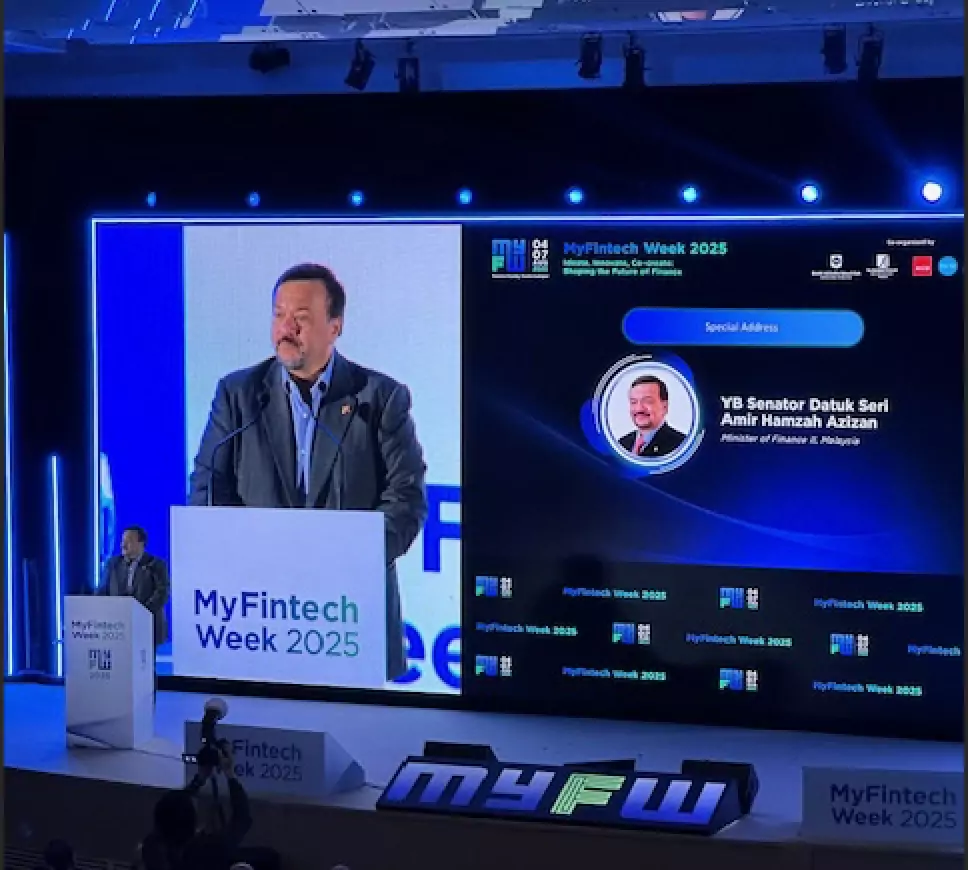

Finance Minister II Amir Hamzah Azizan summarised the country’s priorities in the FIND agenda, which stands for Foster, Invest, Nurture, Democratise: ‘We must promote responsible innovation, invest in strategic sectors, nurture talent and democratise finance to ensure broader economic participation’. The stated goal is to identify and grow five unicorns by 2030, supporting the growth of start-ups with public and private capital and focusing on high-impact technologies.

The Governor of Bank Negara Malaysia, Dato’ Sri Abdul Rasheed Ghaffour, emphasised that “resilience must be integrated at every level: from business continuity to data security, from technology governance to public trust”. With the growth of digital adoption, fraud, cyber threats and third-party risks are also on the rise, and initiatives such as the National Fraud Portal, led by PayNet in collaboration with regulators and authorities, demonstrate how the response must be coordinated and forward-looking. He announced three upcoming regulatory developments: “We have published a Discussion Paper on artificial intelligence, and by the end of the year we will release an Exposure Draft on Open Finance and a Discussion Paper on Asset Tokenisation to ensure safe and valuable adoption for the economy.”

According to Anil Singh Gill, president of FAOM (Fintech Association of Malaysia), Malaysian fintech is undergoing a phase of strategic maturation, characterised by clearer regulations, active specialised verticals and growing collaboration between the public and private sectors. Although a funding gap persists, especially in the early stages of growth where many startups struggle to scale, this challenge is receiving increasing attention thanks to the joint efforts of industry associations and national platforms dedicated to supporting emerging businesses. Innovation continues to be a priority for investors and institutions, with particular interest in Sharia-compliant Islamic finance-based fintech solutions, technologies for SMEs, and ESG-related financial products. These areas are attracting significant investment, confirming that innovation remains at the heart of Malaysia’s fintech ecosystem.

Douglas Feagin, president of Ant International, described how “in 2024, nearly 80% of cross-border payments on PayNet were made via Alipay Plus, connecting over 15 mobile wallets and recording 50% growth quarter-on-quarter.” For Feagin, QR payments are not just technology, but “a bridge connecting Malaysian SMEs to the world.” The integration of artificial intelligence into payment systems, together with public-private interoperability models, is paving the way for increasingly personalised, secure and interconnected services.

The theme of social inclusion was at the heart of the speech by Shahril Azuar Jimin, Group Chief Sustainability Officer at Maybank, who recalled how “in less than ten years, it has become essential for banks to integrate doing good into their strategy.” With the advent of fintech, this commitment has found new avenues, from crowdfunding to peer-to-peer platforms, to digital solutions for connecting merchants and communities. In 2021, Maybank launched the Sasukuti programme, with four commitments: to mobilise 18 billion ringgit (approximately 3.7 billion euros, ed.) in sustainable financing by 2025; improve the lives of two million families in ASEAN by the same date (a target already exceeded); achieve carbon neutrality for operational emissions by 2030 and net zero by 2050; and engage all employees by dedicating one million hours per year to sustainability initiatives. Over the past ten years, the bank has mobilised approximately 46 billion ringgit (9.3 billion euros) in social finance, reaching more than 4.2 million people in the last year alone, with data verified to ensure transparency. Among the initiatives launched thanks to the fintech push are Maybank Hearts, the country’s first banking crowdfunding platform, and Sama-Sama Local, created to bring together and support merchants during the pandemic.

A central aspect of the Malaysian fintech ecosystem is Islamic Finance, a sector that deeply reflects the cultural and religious values of the country and much of Southeast Asia. Malaysia has established itself as one of the leading global hubs for Sharia-compliant financial services, offering innovative solutions that combine sustainability, inclusion and compliance with religious regulations. As Anil Singh Gill also points out, Islamic fintech startups are gaining ground thanks to the development of products tailored to the Muslim community, but with global potential. This innovative niche not only responds to growing demand, but also opens up new investment opportunities, promoting an ethical and responsible finance model that is positively influencing the digital and sustainable transformation of regional financial markets.

From the perspective of international cooperation, Ben Lim, CEO of NEXEA Angels, emphasises that “European companies can connect with the local ecosystem and, through programmes such as our Entrepreneur Programme, connect with networks of local CEOs, gain early customers and understand how to localise their products. This greatly accelerates entry into the Malaysian market.”

Looking beyond 2026, the next phase of the Blueprint will aim for an even more agile, collaborative and impact-oriented financial system. For European businesses, this means access to a dynamic market with evolving regulations, advanced digital infrastructure and a growing focus on partnerships that combine skills, capital and vision to address the global challenges of the future of finance.

ALL RIGHTS RESERVED ©